Are You Working With A Certified Retirement Income Professional?

Designing customized retirement income plans for individuals in or near retirement.

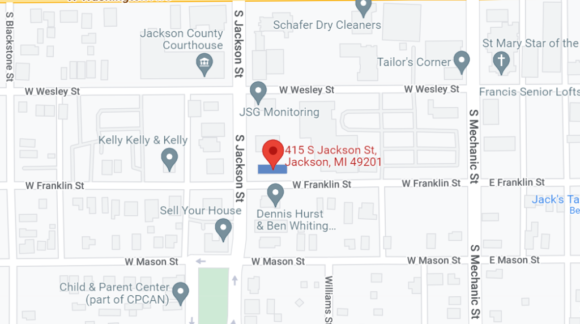

Visit our Main Office:

Stop in for a cup of coffee. We can get to know each other and see if you want to learn more.

Videos

Fox 47 Morning Blend interview with Kevin Snow

Kevin Snow tells Bob and Mary about how Snow Financial helps retirees with their financial planning and investing. Snow Financial is located in Jackson Michigan, give them a call today to talk about your retirement.

Financial advisors urge people to not panic during market swings

U.S. markets stabilized and ended higher Thursday, after an early swoon brought on by Russia’s invasion of Ukraine. The big concern Thursday morning was people’s retirement accounts. “The uncertainty is more than anything that the markets are reacting to right now,” said Kevin Snow, Snow Financial. Snow works with people who are retired. He said […]

Seeking expert financial guidance in Michigan?

Look no further than Snow Financial, a trusted financial advisor dedicated to helping individuals and families achieve their financial goals. Conveniently located in Jackson, Michigan, and with additional locations coming soon.

Michigan

Snow Retirement is a boutique retirement income practice focused on creating plans with predictable, sustainable income cash flow for our clients.

Reach Out For More Information.

Got Questions?

We’d love to visit over a cup of coffee, get to know you and discuss solutions to fit your needs, no obligation.

If you’d like more information, please use the contact form to connect with us.

Message Us for Retirement Information